Hong Kong and Singapore’s pursuit of family office dominance epitomises cooperative competition

By Holly Huang

In the fast-evolving landscape of global wealth management, Asia has experienced a surge in the worth of family enterprises, coupled with the emergence of newly minted billionaires who seek expert counsel for managing their expanding riches.

According to the 2023 Global Family Office Compensation Benchmark Report, some 9% of the world’s family offices are located in Asia. Amid this surge, Hong Kong and Singapore, perennial rivals in the financial domain, are fiercely competing to establish themselves as the preeminent hubs for family offices seeking stability, growth and opportunity. Both cities have rolled out a slew of favourable policies aimed at attracting family offices to set up shop within their borders.

The rise of family offices

Traditionally focused on fast trades and IPOs, many Asian family businesses are now prioritising smooth wealth transition within their families. Although first-generation entrepreneurs remain predominant in controlling Asian wealth and are actively engaged in its administration, the growing complexity of their family needs is driving shifts in investor perspectives and goals.

The growing global presence of affluent Asian families, often sending their children to prestigious universities in North America and Europe, is driving the demand for multi-jurisdictional planning services. Neglecting succession planning can pose significant challenges for the next generation, potentially leading to substantial expenditures on legal fees and taxes. Consequently, Asia-based family offices are expanding their services beyond product sales to include succession planning, tax advisory, and greater access to global markets. Due to the need to address these complex demands, these family offices are not only focusing on talent attraction but also exercising greater caution in terms of where to set up their shops.

In recent years, both governments in Hong Kong and Singapore have made concerted efforts, announcing various measures to attract family offices. In March 2024, a Deloitte study commissioned by InvestHK found there to be about 2,700 single-family offices last year in Hong Kong. For Singapore, the number is around 1,400 as of 31 December 2023, according to the MAS.

Hong Kong: tradition meets innovation

As one of the “Four Asian Tigers” that rapidly grew through the 1980s and 1990s, Hong Kong was the preferred location for Asian family offices during these times. Long hailed as Asia’s financial centre, Hong Kong boasts a rich history of finance and commerce. Its strategic location, robust regulatory framework, and deep-rooted connections with mainland China have made it an attractive destination for businesses and investors alike, particularly those with Chinese links.

Hong Kong’s allure for family offices lies in its well-established financial infrastructure, favourable tax regime, and access to Asia’s burgeoning markets. In 2012, around 100 single-family offices were located in Asia, with Hong Kong accounting for 90% of them. Hong Kong therefore has more experience in family offices than any other city in Asia.

There are several advantages the region presents to Asian family offices: its streamlined setup process for single-family offices is one of them, which does not necessitate external fundraising or licensing — unlike in Singapore, where they need to be approved by Monetary Authority of Singapore (MAS). Hong Kong offers noteworthy tax benefits as well; In Singapore, there is an additional requirement for family office funds to invest at least 10% or SGD$10 million (whichever is lower) of their managed assets in Singapore. Besides, Hong Kong’s vibrant capital market activity, characterised by larger market size and increased trading volume, provides abundant investment opportunities for family offices.

As of 28 March 2024, the Hong Kong Stock Exchange had 2,611 listed companies, while the Singapore Exchange had only 694 listed companies. Hong Kong’s diversified product platform can meet the personalised asset allocation needs of family offices — including bonds, stocks, trusts, private equity investments, hedge funds, art collections, and much more. Additionally, the government’s policies, such as the Capital Investment Entrant Scheme, aim to attract global families and their offices to settle in Hong Kong, thereby fostering demand for wealth management services.

However, the region faces challenges such as political uncertainty stemming from local unrest previously, regulatory complexities, and a shortage of suitable talents, who not only need to have professional backgrounds, but also need to align with family values and contribute to the wealth growth of the second generation.

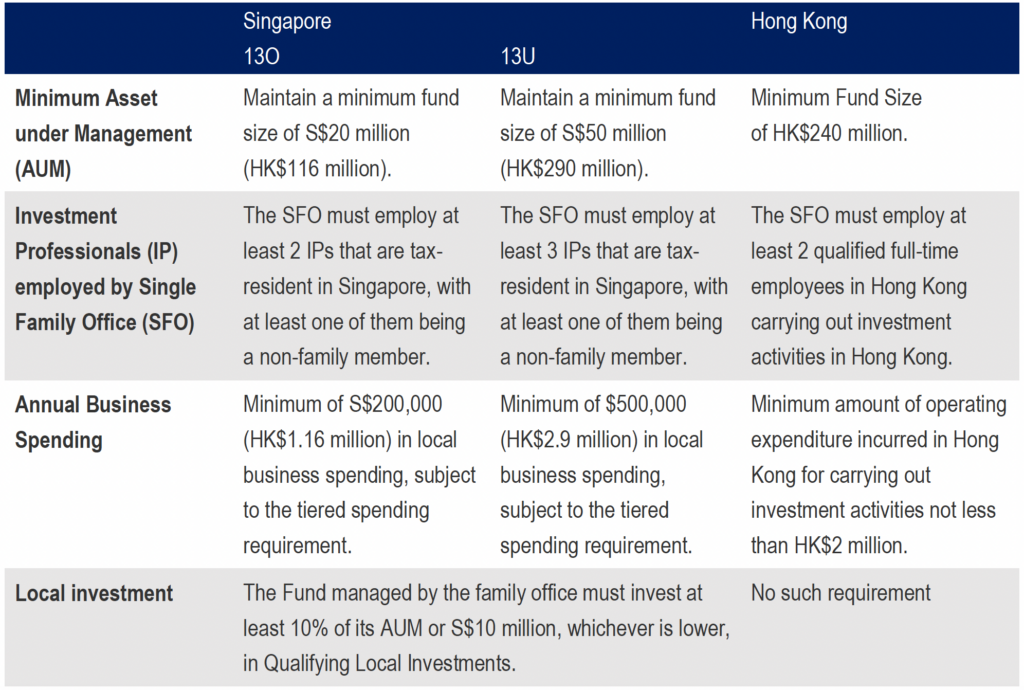

Overview of the differences between Singapore’s and Hong Kong’s tax schemes

Singapore: the Lion City roars

Often dubbed as the “Switzerland of Asia”, Singapore has emerged as a formidable competitor in the race for family office supremacy. With its stable political environment, transparent legal system, and business-friendly policies, Singapore offers a compelling alternative to Hong Kong. The city-state’s reputation for efficiency, integrity, and innovation has attracted a steady influx of wealth from around the globe.

The Lion City’s proactive approach to wealth management, coupled with its commitment to fostering a vibrant ecosystem for finance and technology, has endeared it to family offices seeking a safe haven amid global uncertainties. Over the past decade, Singapore has introduced a series of incentives to attract wealthy families to establish it as a base for asset management, successfully driving the overall growth of the asset management industry in Singapore.

Unlike Hong Kong, Singapore holds a few unique advantages. First, the search for a safe haven for wealth is a significant factor driving high-net-worth individuals to choose Singapore (increasingly, international high-net-worth individuals are wary of China’s fast-evolving regulatory environment across multiple sectors, including Hong Kong’s financial services).

Second, Asian clients tend to have relatively simple assets and family structures, emphasising wealth inheritance. Singapore’s family office system places a strong emphasis on wealth preservation and succession planning due to its lack of inheritance tax and capital gains tax, lower personal and corporate income taxes, as well as its free exchange controls, catering to these needs. Besides, many tech start-ups prefer Singapore due to its favourable tax policies and policy security, enabling them to expand their businesses across Southeast Asia.

Cooperative competition

Comparing Hong Kong and Singapore in the world of finance is like comparing apples and oranges. Each city has its own special qualities tailored to suit different needs and investment styles of families. Hong Kong tends to prioritise capital appreciation, while Singapore leans towards stability.

Due to their differing geographical locations, Hong Kong family offices gravitate more towards opportunities in China, whereas Singapore is oriented towards Southeast Asia, benefitting from its large and relatively young population, which fosters rapid development for family offices. Though it’s obvious that Singapore’s domestic capital market is relatively smaller compared to Hong Kong’s, with less active trading.

As the founder of modern Singapore Lee Kuan Yew once observed, Hong Kong shows how a densely populated island can thrive with limited resources. Despite competition between them, it’s not a negative rivalry. Instead, it’s more of a cooperative competition, benefiting both cities.

In this dynamic setting, family offices have plenty of opportunities to explore, taking advantage of what both Hong Kong and Singapore offer to shape strategies that fit their goals and needs.